Tiraspol, January 15. /Novosti Pridnestrovya/. A number of tax initiatives came into effect on January 1. They were proposed by the Government, supported by the Supreme Council and signed by the President of the PMR at the end of last year. One of them is amendments to the Law On tax on income of organizations, which provide for a reduction in the tax rate on income of organizations by 50-70% for certain industries, sub-sectors of industry. This applies to agricultural, road-building and municipal engineering, automotive, glass and porcelain and faience industry.

“These are areas that have great development potential. Certain measures were taken to stimulate investment activity. Together, all this should have a positive effect and help attract investors to create industries in these sectors. We have a relatively low tax burden precisely in these areas, which creates favorable conditions for activities,” Deputy Minister of Economic Development Maria Glushkova said.

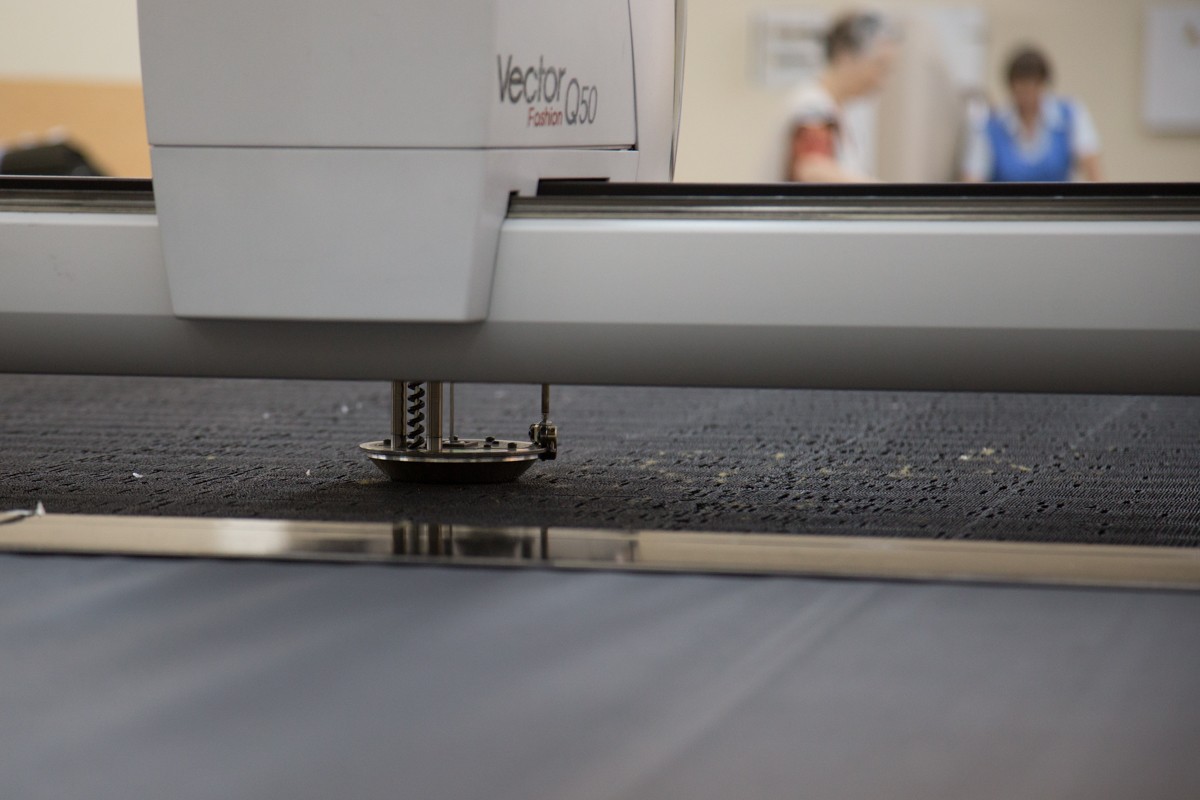

Recall that in 2019, income tax benefits were applied to enterprises in the clothing and footwear industries. An analysis is being made of their effectiveness and the possibility of extension.

Shoemakers and Sewing Enterprises will be able to Cooperate

Since the beginning of the year, amendments have come into force that will allow the shoe and clothing industry to cooperate to fill large orders. We are talking about those who work on tolling raw materials. Sometimes orders are so large (as a rule, they are single) that the enterprise cannot get through them on its own. And if you fill the order together with colleagues, then the products are double taxed.

“The same service was taxed both at the parent enterprise and at the subsidiary, which provided its production and labor resources for processing. The amendments eliminate this, the difference between the total cost of the work performed and the cost of the work performed by the involved organizations is recognized as the tax base. That is, one order is taxed once within the framework of the lead customer. This will also allow increasing the volume of production due to the expansion of the number of orders,” the representative of the Ministry of Economic Development noted.

Additional Funds for the Repair of the Housing Stock

Another legislative initiative that has begun to work concerns the funds raised from the residents of multi-storey buildings for the maintenance of the housing stock. They go to the revenues of management companies (housing department, housing and communal services, housing cooperatives, etc.) under the housing section. They were taxed before, and now they will not be.

“The funds that our housing department collects are not enough to cover the full amount of the costs required for the overhaul of residential buildings. Therefore, we believe that this norm will contribute to the formation of an additional source. Funds will be sent directly for repairs, appropriate programs will be formed with the determination of the objects priority. According to our estimates, the income potential throughout the republic is about 5.5 million rubles per year,” Maria Glushkova said.