Reduced tax burden

Since the beginning of 2017, the tax burden on small businesses has been significantly reduced, namely for individual entrepreneurs working on the patent tax system. The cost of an entrepreneurial patent depends on the size of the Estimated Rate (ER) of the Minimum Salary established by the government. In 2017, it was significantly reduced. In the production sector, the ER has been reduced from 8.1 rubles to 4 rubles; and in the retail sector, to 6 rubles.

In addition, the list of preferences has been expanded for patent holders. For example, members of large families are completely exempt from payment, and citizens who had previously been registered as the unemployed at social protection agencies receive a 100% benefit in the first 6 months as an individual entrepreneur, and 50% in the next six months.

Young professionals have also been granted preferences for paying an entrepreneurial patent. During the first year after graduating from a university or secondary vocational school, they pay only 30% of the patent's cost and another 50% in the following year.

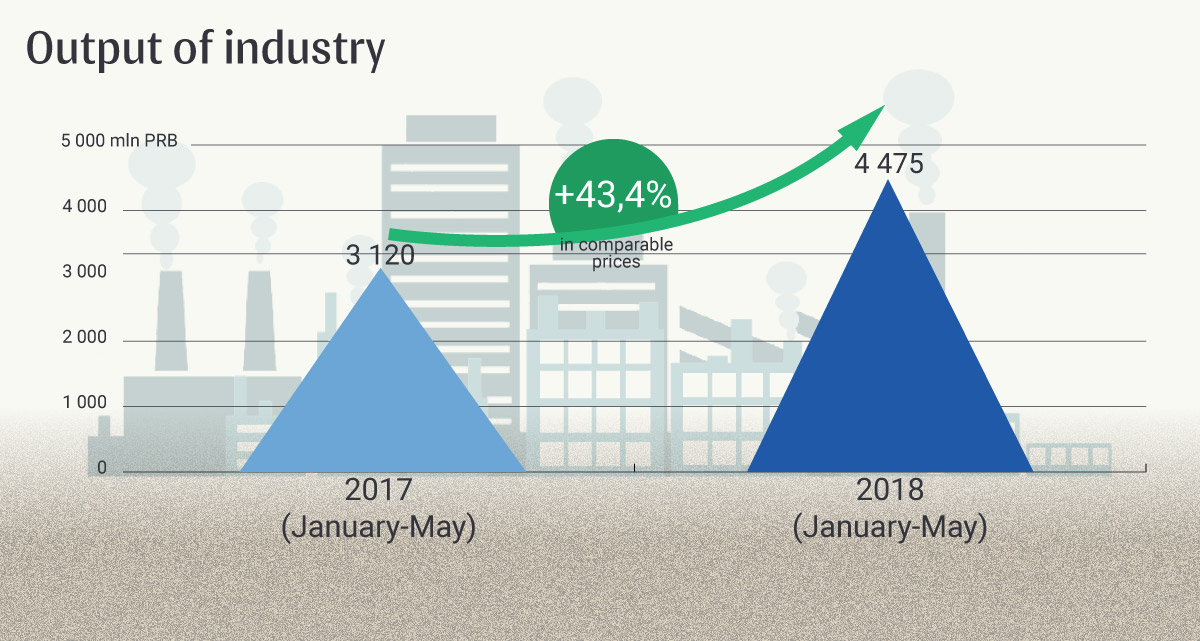

Not only small businesses have benefited from the reduced tax burden. In 2017, the moratorium on the so-called "tax on losses" was extended, and since 1 January 2018, income tax rates for industrial enterprises have been reduced. The tax burden has been reduced by 30-50%, depending on the industry.

The new tax rates were calculated in such a way as to equalize the tax burden on the industry with the burden on trade enterprises that had previously enjoyed a more privileged position.

Simplified foreign trade rules

In 2017, a separate road map was adopted to support exporters, which suggests, among other things, simplified foreign trade procedures.

So, in early 2017, a significant number of amendments to the Customs Code came into force. Many customs procedures were simplified and brought into compliance with the norms adopted in the Customs Union. In addition, the code introduced the concepts of "conscientious foreign trade participant" and "national enterprise". The companies which will be granted such status can quickly go through all the procedures related to customs clearance.

Also in 2017, amnesty was offered to those who had violated the terms of the repatriation of foreign currency earnings.

Elimination of administrative barriers

In addition to the simplified procedures, a road map was also adopted to improve the domestic business environment. It also includes the removal of unnecessary administrative barriers. The first important steps in this direction have already been taken.

So, the government has approved a single list of authorisation documents. While working on it, experts of the Ministry of Economic Development together with representatives of the Union of Industrialists, Agrarians and Entrepreneurs of Pridnestrovie and business association "Most" analyzed more than 160 certificates and licenses. As a result, it was decided to reject 18 documents.

Consulting support

One of the areas of business support is consulting services. Entrepreneurs can receive legal advice from specialists of the Ministry of Economic Development by calling (533) 9-21-49.

There is also the Council on Small Business Support and Development under the Ministry of Economic Development, where various issues are discussed and ways of solving them are suggested.

Investment attraction

Since 1 June 2018, the law "On State Support of Investment Activities" has been in effect in Pridnestrovie. It provides for significant tax breaks for businessmen who decide to open new export-led enterprises or companies that will produce new goods for the Pridnestrovian market.

In addition to tax benefits for investors, the law also guarantees the retention of the existing business conditions and prescribes a mechanism for providing land grants and investment subsidies. With the help of subsidies, entrepreneurs will return 10% of the funds invested in fixed assets. However, the amount of the subsidy will not exceed 100,000 euros.

Other Measures

Since 1 October 2017, individual entrepreneurs have been able to hire up to five employees under civil law contracts. Besides, the list of business activities that can be implemented under a patent with no corporate status has been expanded.